TL,DR

-

- Overall Investment Trend: AI funding is rapidly increasing across all stages, from seed to Series C, indicating strong market confidence and growth potential.

-

- Series Updates:

-

- Early-Stage (Seed/Pre-Seed): Focus on foundational and innovative AI technologies. (iPNOTE, Mimic Robotics, MidLyr, others)

- Series A (Scaling & Market Fit): Emphasis on scaling products and proving market viability. (Mem0)

- Series B (Growth & Market Expansion): Focus on accelerating growth and expanding market presence. (ConductorOne, Agtonomy)Series C (Market Leadership & Innovation): Aiming for industry dominance and cutting-edge innovation. (Fireworks AI)

-

- Series Updates:

-

- Geographic Focus: The investment activity continues to be concentrated in certain regions, maintaining trend consistency.

-

- Key Themes & Drivers:

-

- Practical AI solutions across diverse sectors (research, legal, financial, security, military, SEO, robotics).

- Steady push towards market leadership and innovation at each stage of funding.

-

- Key Themes & Drivers:

The artificial intelligence landscape is a dynamic, ever-evolving frontier, and its heart beats strongest in the rhythm of investment. From nascent seed rounds to colossal Series C injections, capital continues to flood innovative AI companies, signaling a resounding confidence in the sector’s transformative potential. For AI enthusiasts and savvy investors alike, understanding these funding trends provides invaluable insight into the technologies poised to reshape our world and the companies leading the charge.

The Early Bloomers: Seed and Pre-Seed Rounds Fueling Foundational Innovation

While the headlines often focus on the mega-rounds, the bedrock of AI innovation is laid in the earliest stages of funding. Seed and pre-seed investments, though smaller in dollar amount, are critical for nurturing nascent ideas and bringing groundbreaking concepts to fruition. These rounds are a testament to venture capitalists’ willingness to bet on early-stage potential, often before a product has reached full market maturity.

Bellman Secures $500,000 for AI-Powered Research Tools

One prominent trend emerging from these early rounds is the continued dominance of Y Combinator (YC). The renowned accelerator has once again demonstrated its influence, backing several promising AI startups. Bellman, a San Francisco-based AI analytics company, secured 500k from the Y Combinator Fall 2025 Batch. Their AI technology automatically generates high-quality interview questions tailored toward research goals, whether it’s feature validation, pricing, churn analysis, or market trends.

Moss Receives $500,000 for Semantic Search

Moss, focusing on semantic search, also garnered 500k from the same YC batch. The company’s plug-and-play semantic search platform provides real-time retrieval inside apps, browsers, and enterprise agents with centralized management, analytics, and scale built in. It runs wherever your intelligence lives, be it in-browser, on-device, or in the cloud.

iPNOTE Rounds-Up $1 Million for AI-Powered IP Law Platform

In 2023, inventors and companies around the world filed over 23 million intellectual property applications, including patents, trademarks, utility models, and industrial designs. iPNOTE’s platform is looking to make those processes more efficient and labor-free. The company’s technology is essentially an AI paralegal – a virtual assistant that can simultaneously manage global IP filings and handle up to 90% of routine communications with providers. The AI oversees the entire IP registration workflow: answers attorney questions, reviews deliverables, summarizes documents, tracks deadlines, sends follow-ups to providers, monitors progress from filing to grant, and processes payments. Investors like the idea, as iPNOTE raised $1 million in Seed funding.

MidLyr Raises $2.5 Million for Financial Compliance AI

What distinguishes financial institutions is the need for every process, tool, and workflow to incorporate risk considerations. Modeling financial, regulatory, and operational risks is intricate and continuously evolving. MidLyr empowers organizations to operate any workflow within robust guardrails set by regulations, internal policies, and shifting business objectives. The Los Angeles-based MidLyr secured $2.5 million in pre-Seed investment from Silicon Badia and Wedbush Ventures, among others.

DeepSafe Raises $3 Million for Cryptographic Security

Beyond YC, other investors are actively scouting for the next big thing. DeepSafe, headquartered in Cupertino, California, secured a robust $3 million in seed funding for its cryptographic engine, from crypto-native investors like SatoshiLab and Cogitent Ventures. The company’s technology provides a universal verification layer for data anywhere, and next-generation blockchain security and omnichain verification. The funding will be used, in part, to fund completion of DeepSafe’s AI agent.

SalesPatriot Gets $5 Million for Military Procurement AI

San Francisco-based SalesPatriot secured $5 million to modernize procurement for defense and aerospace, with backing from Pear VC and Y Combinator. The U.S. defense industrial base still runs on systems built in the 1980s. Distributors and manufacturers rely on a patchwork of emails, PDFs, supplier quotes, and outdated ERP tools to manage billions of dollars in critical components. SalesPatriot is replacing that with a unified, AI-native platform.

The Prompting Company Secures $6.5 Million for AI SEO Platform

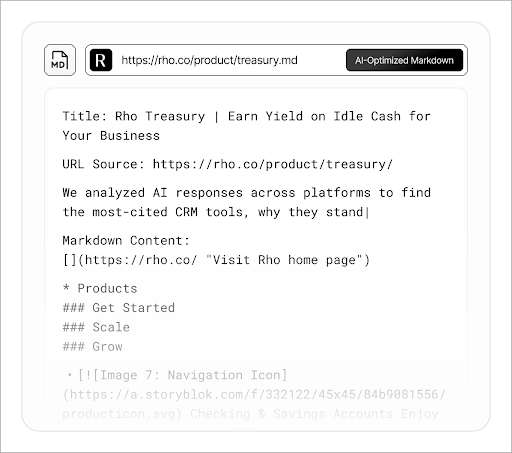

Another intriguing seed round saw The Prompting Company from San Francisco raise $6.5 million from heavy hitters like Peak XV Partners and Base10 Partners. The company’s platform helps optimize website content to deliver high AI search results. The platform follows a three-part process. First, it finds the exact questions users ask and check how often your brand is mentioned. Next, it creates AI-optimized content before finally routing AI to a clean, markdown version of the page, free of human-facing clutter, for faster and more accurate answers.

Source: The Prompting Company Website

Mimic Robotics Raises $16 Million for AI Robotics

Swiss robotics startup mimic received $16 million in seed funding round to advance its frontier physical AI for robots, positioning itself as a key European player in the global robotics race. The company’s technology enables robots to perform complex, dexterous tasks in manufacturing and logistics, addressing labor shortages and reshoring efforts.

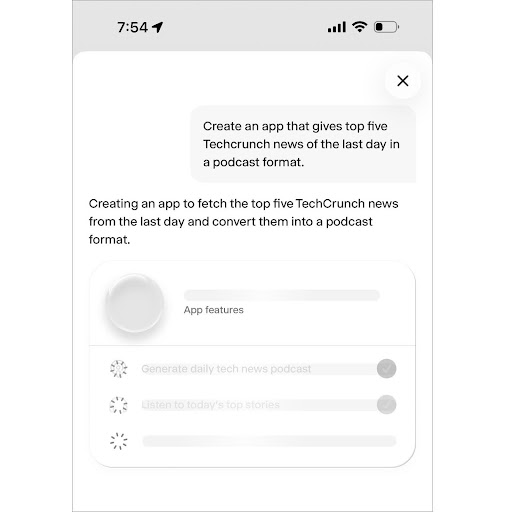

Wabi Grabs $20 Million in Pre-Seed for AI App

The founder of Replika raised $20 million in pre-seed funding from a stellar list of angels, to further develop what it calls the “YouTube of Apps.” The app, named Wabi, has been committed to remain add-less as it allows users to no-code build apps then share them through a social network. According to the company’s founder, Eugenia Kuyda, all you need to put in is ‘build me an AI therapy app,’ and the app will suggest features, and you can brainstorm with it. “You don’t need to be great at prompting. You never see the code,” she explained.

Source: Image Screenshot, Wabi

Series A: Scaling Up and Proving Product-Market Fit

As companies mature past their initial seed stages, Series A funding becomes crucial for scaling operations, expanding teams, and solidifying product-market fit. This stage often signifies a transition from concept to tangible growth, attracting investors looking for more established potential.

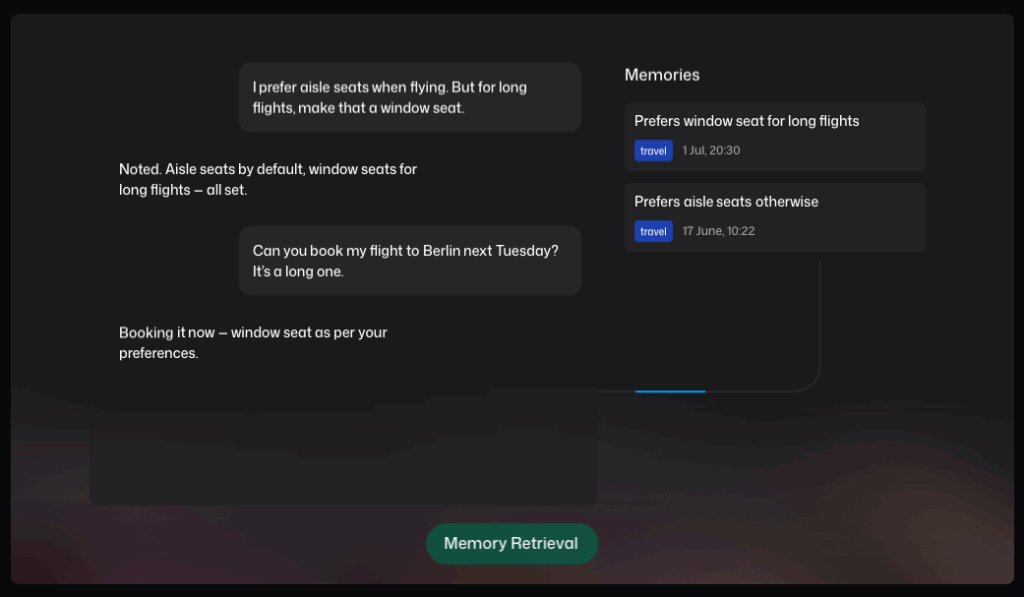

Mem0 Secures $23.9 Million for Efficient AI Application Development

Mem0, a Mountain View, California-based company specializing in LLM enhancement, secured a substantial $23.9 million Series A round. This impressive sum, backed by Y Combinator and Kindred Ventures, among others, will fuel the company’s universal, self‑improving memory layer for LLM applications, powering personalised AI experiences. The browser-based tool helped Sunflower Sober scale personalized recovery support to 80,000+ users.

Source: Mem0 Website

Series B: Accelerating Growth and Market Expansion

Series B rounds signify a company’s readiness for significant acceleration and often precede a period of rapid market expansion. At this stage, companies typically have a proven business model, a growing customer base, and a clear roadmap for scaling.

ConductorOne

ConductorOne, a San Francisco-based company, successfully secured a hefty $79 million in Series B funding. This impressive round, backed by industry giants like CrowdStrike Falcon and Accel, highlights the increasing integration of AI into tangible infrastructure. The company’s AI-native identity security platform capable of handling the exponential growth of human, non-human, and AI identities, helping some of the world’s largest enterprises secure their workforces in the AI era.

Agtonomy

From precision farming and crop yield optimization to automated machinery and predictive analytics for disease outbreaks, AI is poised to revolutionize food production, addressing global challenges of food security and resource management. One company, Agtonomy from San Francisco, raised $18 million in Series B funding to participate in this technological revolution. With support from Autotech Ventures and Nuveen Investments, the company’s AI-driven automation helps growers tackle labor shortages, improve efficiency, and manage rising costs embedded at the factory level with the world’s leading equipment brands.

Source: Agronomy Website

Series C: The Big Leagues – Cementing Market Leadership and Innovation

Series C rounds are reserved for companies that have demonstrated substantial success and are poised for significant market disruption or consolidation. These investments are often substantial, reflecting a high degree of investor confidence in the company’s long-term trajectory and potential for outsized returns.

Fireworks AI

The standout in recent funding news is undoubtedly Fireworks AI, based in Redwood City, California, which secured a colossal $250 million in Series C funding. This immense investment, led by Lightspeed Venture Partners and Evantic Capital, supports growth of the company’s open-source AI models at blazing speed, optimized for individual use cases, scaled globally with the Fireworks Inference Cloud. Fireworks AI’s customers like Cresta, the AI platform for contact centers, uses Fireworks to power Knowledge Assist, a real-time, context-aware guidance for agents by unifying information from multiple sources. With Fireworks’ scalable infrastructure and Multi-LoRA tech, Cresta cut costs by up to 100× versus GPT-4, boosting agent efficiency and customer satisfaction at scale.

Geographic Concentration Continues

The funding data reveals the continued dominance of the San Francisco Bay Area, which accounts for approximately 65% of the featured investments, with a concentration in the city itself. Mountain View, Redwood City, San Francisco, and San Mateo all feature prominently, reinforcing Silicon Valley’s central role in AI innovation and funding.

Key Themes and Underlying Drivers:

Several overarching themes emerge from these recent funding announcements:

-

- The Universality of AI: From defense to agriculture, business intelligence to building technology, these investments demonstrate that AI is no longer a niche technology but a ubiquitous enabler across virtually every industry.

-

- Generative AI’s meteoric rise: The staggering investment in Fireworks AI underscores the immense excitement and projected impact of generative AI, pushing the boundaries of creativity and efficiency.

-

- The Infrastructure Behind the Intelligence: Investments in “Development Tools” (Mem0) and “Building Analytics” (ConductorOne) highlight the critical need for robust infrastructure to support the proliferation and scaling of AI applications.

-

- Ethical AI and Security Concerns: DeepSafe’s focus on a “Cryptographic Engine” with AI hints at a growing investor awareness of the need for secure and trustworthy AI systems, especially as AI becomes more integrated into critical functions.

-

- Efficiency and Automation: Companies like The Prompting Company (SaaS), Bellman (Analytics), and MidLyr (Business Intelligence) all address the fundamental business need for greater efficiency, automation, and data-driven insights.