In the past week alone, AI startups have secured an additional $1.7 billion in funding, building upon the extraordinary $5.5 billion influx recorded just the previous week. This surge underscores the accelerating pace of investment flowing into artificial intelligence ventures worldwide. Notably, recent trends reveal that this funding is not confined solely to San Francisco and Silicon Valley anymore.

Instead, we are witnessing a marked increase in capital being allocated to AI companies across a diverse range of geographic locations, as innovation hubs continue to emerge and flourish well beyond the traditional tech strongholds. This growing geographical dispersion demonstrates the global appetite for AI innovation and highlights the expanding footprint of the industry.

Pre-Seed Rounds

Early-stage pre-seed and seed funding plays an essential role in nurturing innovative ideas and turning bold visions into tangible products.

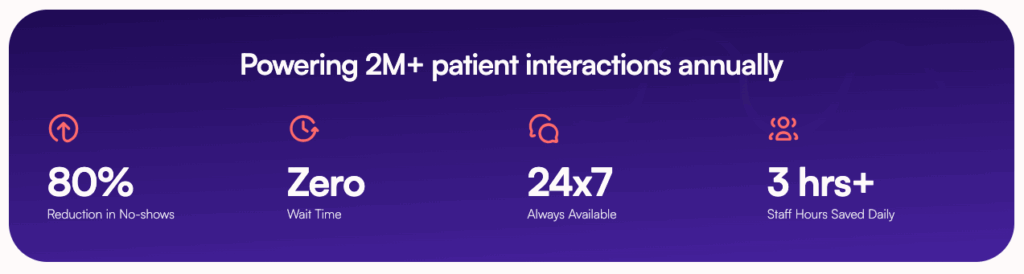

Pype AI

Pype AI raised $1.2 million in pre-seed funding to build healthcare-specialized voice agents. The company aims to transform doctor-patient interactions by creating AI assistants that understand medical terminology and can document consultations in real-time. Based in Boston, Pype AI was founded by former healthcare professionals seeking to reduce administrative burden in clinical settings.

Source: Pype AI Website

Circle

Circle secured ₹3.4 crore (~$410K) in pre-seed capital to expand its AI-verified consumer-to-consumer marketplace. The Bangalore-based startup uses artificial intelligence to authenticate products and verify transactions between individual sellers and buyers. Circle’s technology addresses trust issues in second-hand marketplaces by providing AI-powered verification for high-value items.

Seed Rounds

BluePill

BluePill launched with $6 million seed funding to replace traditional market research with AI-powered digital consumers. The Seattle-based company has developed synthetic consumer profiles that can simulate purchasing decisions and brand interactions at scale. BluePill’s technology allows brands to test marketing strategies against thousands of AI personas representing different demographic segments.

PoobahAI

PoobahAI raised $2 million to enable no-code AI-built blockchains and automated on-chain agents. The Fort Worth, Texas-based startup is democratizing blockchain development by allowing non-technical users to deploy custom chains through conversational AI interfaces. PoobahAI’s platform represents a significant step toward making distributed ledger technology accessible to mainstream business users.

Runlayer

Runlayer launched with an $11 million seed round to secure MCP-based AI agent ecosystems. Based in Seattle, the company provides security infrastructure for multi-agent AI systems operating across different computational environments. Runlayer’s technology connects disparate AI systems and data sources.

PicoJool

PicoJool raised $12 million in seed financing to scale high-bandwidth optical interconnects for hyperscale AI clusters. The Austin-based deep tech startup is developing photonic chip technology that dramatically increases data transfer speeds between AI processors. PicoJool’s innovations address one of the most significant bottlenecks in large-scale AI computing: the movement of data between processing units.

Asseta AI

Asseta AI secured $4.2 million in seed funding to modernize family-office operational infrastructure. The London-headquartered fintech uses artificial intelligence to streamline investment management and reporting for ultra-high-net-worth family offices. Asseta AI’s platform consolidates disparate financial data sources and provides AI-powered insights for wealth preservation and growth.

Teacher’s Buddy

Teacher’s Buddy closed $1.85 million in seed funding to reduce teacher burnout through AI-driven workflow automation. The Melbourne-based edtech startup provides AI tools that handle administrative tasks like grading, lesson planning, and student feedback. Teacher’s Buddy allows educators to focus more time on direct student interaction while maintaining high-quality educational outcomes.

Arbiter

Arbiter raised $52 million in a high-profile seed round at about 400 million valuation to automate healthcare administration. The Boston-based healthcare AI company is tackling the massive inefficiencies in medical billing and insurance processing that cost the US healthcare system billions annually. Arbiter’s unusually large seed round reflects investor confidence in the company’s potential to transform healthcare operations.

AlphaXiv

AlphaXiv closed a $7 million seed round to become the collaboration layer bridging AI research and production. The Berkeley-headquartered platform enables seamless transition of academic AI research into production-ready applications. AlphaXiv addresses the growing gap between theoretical AI advances and practical implementation in industry settings.

Source: AlphaXiv Website

Kaaj

Kaaj raised $3.8 million to automate underwriting and small-business credit intelligence. The Mumbai-based fintech uses AI to analyze alternative data sources for credit decisioning for small businesses traditionally underserved by financial institutions. Kaaj’s technology enables faster loan approvals for millions of small enterprises that lack conventional credit histories.

Ember

Ember raised $4.3 million to expand its healthcare-AI infrastructure. The San Francisco-based startup provides HIPAA-compliant AI development tools specifically designed for healthcare applications. Ember’s platform enables medical institutions to build and deploy custom AI solutions while maintaining strict patient data privacy and regulatory compliance.

Series A Rounds

Source: AI-Generated by Andre Bourque

PowerLattice

PowerLattice raised $25 million in Series A funding to commercialize ultra-low-power chiplet architectures. The Vancouver, Washington-headquartered semiconductor company is developing modular AI chips that consume a fraction of the energy required by conventional processors. PowerLattice’s technology addresses the growing environmental concerns around energy consumption in AI data centers.

Maxima

Accounting AI startup, Maxima, raised approximately $41 million across Seed + Series A to automate enterprise accounting workflows using AI and advanced its enterprise rollout with a ~143 million valuation. The San Mateo-based fintech company uses machine learning to automate complex financial reconciliation and reporting processes for large corporations. Maxima’s platform reduces accounting errors while dramatically accelerating month-end closing procedures.

Modern Life

Modern Life secured $20 million in Series A funding to modernize life-insurance advisory with AI workflows. The New York-based insurtech company combines human expertise with artificial intelligence to streamline the traditionally complex process of life insurance selection and underwriting. Modern Life’s platform matches consumers with appropriate coverage options while reducing application processing time from weeks to days.

Flexion

Zurich-based Flexion raised $50 million in Series A capital to develop intelligence systems for humanoid robots. The robotics company is creating AI control systems that enable bipedal robots to navigate complex environments and perform dexterous manipulation tasks. Flexion’s technology represents a significant advancement in making humanoid robots practical for real-world applications beyond controlled industrial settings.

Source: Flexion

Redrob

New York-based Redrob closed a $10 million Series A to scale its large-language-model infrastructure. The AI infrastructure company provides specialized cloud computing resources optimized for training and deploying large language models. Redrob’s platform enables smaller organizations to develop custom AI models without the massive computing investments typically required, and is now the world’s third largest LLM.

Source: Redrob Website

Series B Rounds

Source: AI-Generated by Andre Bourque

Celero Communications

Celero Communications secured $140 million in Series B funding to advance coherent DSP and optical connectivity for AI data centers. The Irvine, California-based company develops high-speed optical networking technology that enables massive data transfers required by distributed AI training systems. Celero’s innovations address the growing bandwidth demands of AI clusters that process increasingly large datasets.

Sakana AI

Sakana AI closed $135 million in Series B funding at a 2.65 billion valuation to scale Japan-optimized foundation models. The Tokyo-headquartered AI research company, founded by former Google Brain researchers, is developing large language models specifically tuned for Japanese language and cultural contexts. Sakana AI represents Japan’s growing ambition to develop sovereign AI capabilities independent of US and Chinese models.

Agentio

Agentio secured $40 million in Series B funding to deepen its creator-powered advertising platform. The New York-based adtech company uses AI to match content creators with brands for authentic marketing partnerships. Agentio’s technology analyzes creator content and audience engagement patterns to identify optimal brand collaborations.

Function Health

Austin, Texas-based Function Health raised $298 million in Series B financing at a valuation near $2.5 billion, accelerating its AI-powered medical intelligence platform. The healthcare AI company provides diagnostic decision support systems that analyze patient data to suggest potential conditions and appropriate tests. Function Health’s platform is being adopted by major hospital systems seeking to improve diagnostic accuracy and reduce medical errors.

Series C and Beyond

Ramp

Ramp hits $32 billion valuation with new $300 million funding round as investors double down on autonomous finance. The New York-based fintech unicorn continues its meteoric rise with AI-powered expense management and corporate card solutions that automatically categorize transactions and identify savings opportunities. Ramp’s latest funding solidifies its position as one of the most valuable private fintech companies globally.

Source: Ramp Website

Suno

Cambridge, Massachusetts-based Suno secured $250 million in Series C funding to expand its rapidly growing AI music ecosystem. The creative AI company has developed technology that can compose original music in various genres based on text descriptions. Suno’s platform is revolutionizing music creation for content creators, advertisers, and entertainment companies seeking custom soundtracks.

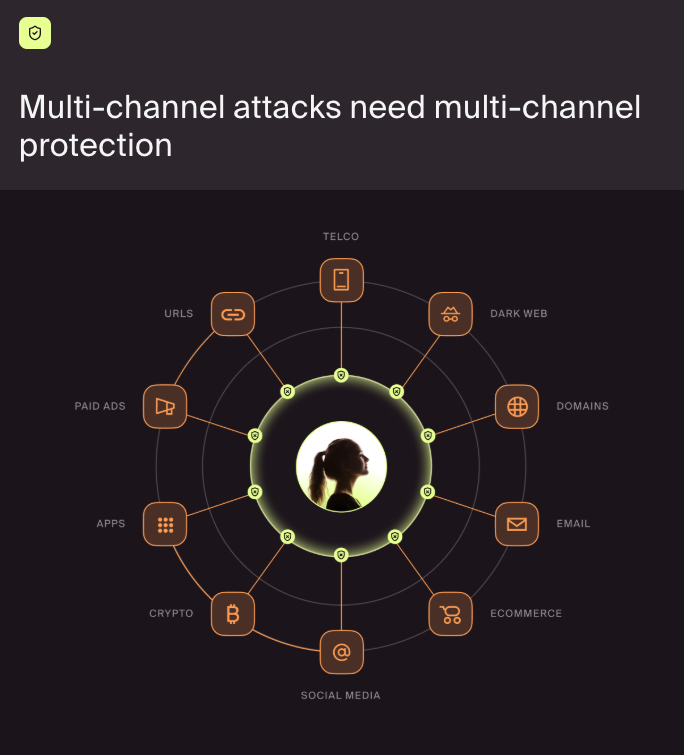

Doppel

Doppel closed $70 million in Series C funding at a valuation exceeding 600 million to counter AI-driven impersonation threats. The cybersecurity company provides detection systems for identifying deepfakes and synthetic media used in corporate fraud and disinformation campaigns. Doppel’s technology has become increasingly critical as AI-generated content becomes indistinguishable from human-created media.

Source: Dopple Website

Strategic Investments and Fund Raises

LegalTech Fund

LegalTech Fund raised a $110 million second fund to back next-generation AI legal startups. The Florida-based venture capital firm focuses exclusively on technologies transforming the legal industry through automation and artificial intelligence. LegalTech Fund’s portfolio spans contract analysis, legal research, and compliance automation startups.

Norm AI

Another Legal AI startup, Norm AI, received a $50 million strategic investment while launching its AI-native legal services arm. The New York-based company combines traditional legal expertise with artificial intelligence to provide more efficient legal services to corporate clients. Norm AI’s strategic investment comes from a consortium of major law firms seeking to modernize their service delivery.

Source: Norm AI Website

AgroStar

India’s AgroStar secured $30 million to accelerate digital agriculture adoption across the country. The Pune-based agritech company uses AI to provide farmers with personalized crop advisory, weather forecasts, and market linkages through a mobile application. AgroStar’s platform serves millions of small-scale farmers who previously lacked access to agricultural expertise and market information.

Wispr Flow

Wispr Flow raised $25 million to grow its voice-first AI productivity platform. The San Francisco-based startup has developed an ambient computing system that listens to meetings and automatically generates summaries, action items, and follow-ups. Wispr’s technology is five times faster than typing, and after six months, the average person writes nearly three-quarters of their characters by voice.

Source: Wispr Flow Website

The Road Ahead: What’s Next for Global AI Innovation?

The torrential influx of capital into AI startups signals more than just an investment trend, it heralds a new era of technological transformation spreading well beyond legacy tech corridors. As funding surges in unexpected geographies from Tokyo to Texas, several future-shaping themes are emerging:

1. The Rise of Specialized AI Ecosystems

We are witnessing a pivot from “one-size-fits-all” AI platforms to domain-specific solutions. Startups like Sakana AI (tailoring LLMs to Japan’s context), Asseta AI (family-office wealth management), and Teacher’s Buddy (education automation) point to innovation deeply rooted in industry and culture. As more capital flows into such niche players, we can expect increasingly precise AI tools across sectors—healthcare, finance, agriculture, and even creative industries.

2. Infrastructure to Fuel the Next Leap

Rising demand for data, storage, and computational muscle is driving massive investments in AI hardware and infrastructure. Companies like PowerLattice (ultra-low-power processors) and PicoJool (photonic chip data transfer) lay the groundwork for the next generation of sustainable, high-performance AI, essential as adoption spreads globally and environmental concerns amplify.

3. Democratization and Accessibility

A defining trend is the democratization of AI capabilities. PoobahAI’s no-code blockchain agents and Redrob’s infrastructure for smaller organizations exemplify how funding is empowering more users, including those outside traditional tech circles, to harness AI’s benefits. This will likely accelerate digital transformation for SMEs, educators, and non-technical professionals worldwide.

4. Heightened Focus on Trust and Security

As AI-generated content and multi-agent systems proliferate, threats like deepfakes and impersonation become more prevalent. The rapid fundraising of Doppel and Runlayer underscores the increasing value placed on trust, security, and compliance frameworks. Expect significant advances in AI for cybersecurity, digital identity, and regulatory automation in coming years.

5. Global Collaboration and Competition

The funding boom’s broad geographic reach signals that AI development is becoming more collaborative yet also more competitive globally. Initiatives like AlphaXiv’s bridge between research and production, and strategic plays by LegalTech Fund and AgroStar, reflect a future where cross-border partnerships and sovereign AI capabilities will drive both innovation and regulatory debates.

Looking Forward

As AI permeates nearly every facet of industry and society, the flow of capital will shape not only what gets built, but who builds it and for whom. Investors show no sign of slowing; if anything, competition for the next transformative breakthrough is heating up. We can anticipate a world where AI becomes the invisible engine of productivity, creativity, and problem-solving, served locally, scaled globally, and governed with greater sophistication. The coming years will likely see not just new products, but new business models, regulatory paradigms, and societal norms shaped by artificial intelligence.

In this evolving landscape, one thing is clear: the future of AI will be defined as much by its diversity and reach as by its technical ingenuity. The opportunity now lies in turning global funding momentum into solutions that matter for everyone, everywhere.

Feature Image: AI-Generated by Andre Bourque