The surge in artificial intelligence (AI) funding shows no signs of slowing, with strategic investments spanning different development stages and sectors. As startups drive innovation, from groundbreaking research to widespread market implementation, examining the latest funding trends provides critical insights into the shifting priorities and key factors propelling the future of AI and the capital fueling its advancement.

Early Stage AI Funding: Cars, Restaurants, and Prayer Rings

GreenFi

The second investment in Singapore-based AI technology in as many weeks, GreenFi brought in a $2 million seed round. The ESG AI company provides accessible no-code AI technology to help banks and brands automate all aspects of their sustainability and augment their decision-making in a world of infinitely complex data. GreenFi’s focus on compliance automation positions it well for regulators’ next wave of sustainability mandates.

Greenshoe

Greenshoe raised $3 million in seed funding to automate SEC reporting with AI. The Chicago-based company’s product is the first AI-native platform built specifically to automate and improve U.S. Securities and Exchange Commission (SEC) disclosures. “SEC filings are the foundation of market transparency, but the workflows powering them are stuck in a pre-AI world,” said Payton McCoy, CEO and co-founder of Greenshoe.

Uare.ai

Palo Alto-based Uare.ai (previously known as Eternos.life) has secured $10.3 million in seed funding. The company’s platform captures a user’s voice, memory, and way of thinking – evolving with the person over time. Uare.ai was designed to be built on individuality, safeguarded by design, and with user control.

OneLot

Philippines-based startup OneLot raised $3.3 million in a seed round to support used car dealers by providing access to financing and digital tools. The platform combines AI-powered underwriting with on-the-ground vehicle appraisals, enabling dealers to apply for secured inventory loans and receive approvals in hours rather than weeks.

Crustdata

Crustdata, a Y Combinator-backed startup, raised $6 million in seed funding. The San Francisco-based company addresses a fundamental challenge with AI language models: Most traditional web data, typically updated on a monthly or quarterly basis and structured with outdated schemas, lacks the freshness, structure, and real-time availability needed for autonomous AI systems. Crustdata’s platform overcomes this issue by using real-time crawlers to index the web, delivering dynamic and verifiable data on companies and people.

Quickads

A product I enjoy and purchased at AppSumo when it was still in early stages, Quickads, added $1.7 million in seed funding to expand its generative-AI content engine. The Dallas-based company’s product uses AI to analyze winning social ads and generate image or video content advertising based on that data.

Source: Quickads Instagram

Theo AI

Theo Ai Inc., based in Palo Alto, has secured $3.4 million to advance its predictive litigation analytics platform. The platform uses advanced data analysis and machine learning to help legal teams anticipate case outcomes and optimize strategies. This funding will support further technology development and expansion into new markets for the AI-powered dispute resolution platform

Confidein

Confidein, a niche faith AI company raised $6 million in seed funding to scale its innovative AI-powered prayer ring. The Prayer Ring by Confidein is designed to foster a deeper sense of spiritual connection for users, providing them with a unique way to engage with their faith. It facilitates the exchange of anonymous prayers and blessings within a global network of users, transcending geographical and temporal boundaries to unite individuals in a shared spiritual experience.

The Prayer Ring by Confidein is a wearable device that reimagines how believers access spiritual guidance and connect with their faith communities. By simply tapping a smartphone to the ring, users receive personalized scripture verses matched to their selected mood or feeling.

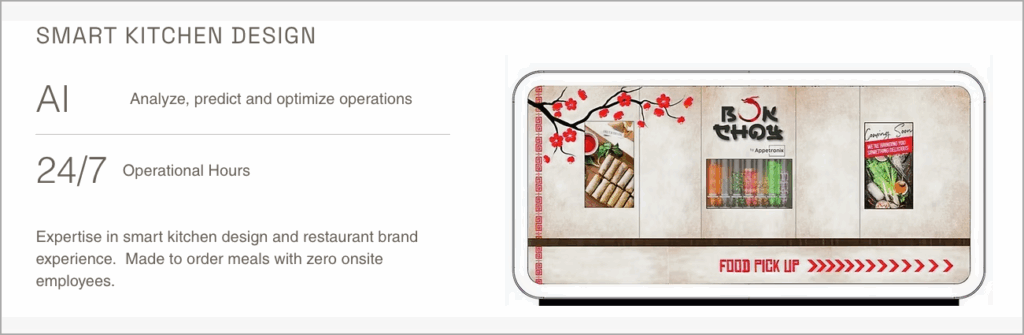

Appetronix

“To optimize ai, robotics and automation to revolutionize the next generation of quick-service restaurants,” is the vision of Appetronix, an AI robotics company that secured $6 million in Seed funding. The Toronto-based company produces a robotic quick service restaurant with zero onsite employees, the size of a small food truck.

Source: Appetronics Website

Accipiter Biosciences

Accipiter Biosciences, a Seattle-based biotech startup, generated a seed funding round of $12.7 million. The company specializes in AI-driven protein design, utilizing machine learning to create innovative therapeutic molecules and addressing what it refers to as “undruggable” protein targets. The funding will support the advancement of its AI protein design platform, expansion of in-house laboratory capabilities, and progression of early-stage therapeutic candidates.

BoomPop

The corporate group travel and events market is valued at $1 trillion. Tapping into this sector, AI-native event planning software company BoomPop secured $41 million in a combination of VC and credit funds. “Many people don’t realize meetings and events are a company’s second- or third-biggest line item in the P&L,” said Healey Cypher, Co-Founder and CEO of BoomPop. “Especially in an AI-driven world, nothing replaces authentic human connection. BoomPop makes that simple. Our mission is to be the default way the world gets together.”

Series A AI Breakthroughs: All About AI Agents

Parallel Web Systems

Parallel Web Systems, another Palo Alto California-based company, secured $100 million in Series A funding to build an internet layer optimized for AI agents. The platform is designed not for human users, but for AI agents. Instead of ranking search results for humans to click, Parallel creates APIs that let AI agents search the live web, retrieve updated information, and operate with higher accuracy.

WisdomAI

WisdomAI, headquartered in San Mateo, California, closed a $50 million Series A funding round. The company has developed technology allowing users to chat with their data to get instant, visual insights.

Wonderful

Amsterdam-headquartered (R&D in Israel) startup, Wonderful, secured $100 million Series A to scale multilingual, culturally adaptive AI agents for enterprises. The company has built enterprise-grade multilingual AI agents across chat, voice, and email, with markets across Europe and the Middle East. Their AI agents don’t just translate words; they adapt tone, phrasing, and behavior to match local customs.

sim

Founded by Emir Karabeg and Waleed Latif earlier this year, sim grew from a small San Francisco apartment to a community of 60,000 developers and 18,000 GitHub stars, recently raising a $7 million Series A. The company’s solution connects LLMs to tools like Slack, Supabase, Pinecone, and Gmail to create research agents, support bots, or data transformation agents. Instead of wiring everything in code, you just drag, drop, connect, and run.

Series B AI Investments: AI Meets Little League & Interest in Chips Grows

AI-Generated by Andre Bourque

Majestic Labs

AI chip startup Majestic Labs drew in $100 million in a Series B funding to address the persistent memory bottleneck in AI systems. The company’s mission is to condense the memory capacity of ten server racks into a single system, effectively overcoming the “memory wall” that limits AI workloads. By resolving this critical barrier between compute and memory, Majestic aims to significantly enhance the speed, cost-efficiency, and overall performance of large-scale AI training and inference.

Foxglove

San Francisco-based Foxglove raised $40 million in Series B funding to further develop its robotics and Physical-AI data platform. The platform provides essential tools for visualizing, debugging, and collaborating on robotics data, accelerating the development and deployment of advanced robotic systems. This funding will enable Foxglove to expand its team and enhance the platform’s capabilities, solidifying its position as a key player in the robotics ecosystem.

Beacon Software

Beacon Software secured $250 million in Series B funding to modernize vertical software with AI. The company’s model focuses on revitalizing software products serving underrepresented industries, from youth sports leagues to campgrounds, by embedding AI capabilities that make them more profitable. Beacon Software acquires existing companies, transforms them with AI, and emphasizes permanent ownership over rapid exits. And the industries they target are often big-money overlooked: The camping market will grow by 7.28% (twice as fast as the hotel industry), and hit $60 billion in revenue by 2027.

Source: Beacon Software Website

Sweet Security

Tel Aviv-based Sweet Security has raised $75 million in Series B funding to further develop its AI-native cloud security suite. The company’s platform leverages artificial intelligence to provide comprehensive protection for cloud environments, addressing the growing challenges of modern cybersecurity threats. The company’s ability to combine real-time cloud protection with AI-powered intelligence has been called “unlike anything else in the market” and is poised to redefine how enterprises secure the modern cloud and go about securing their AI environments.

GC AI

GC AI, a San Francisco-based legal AI company, closed $60 million in Series B funding to scale its AI workspace. The company’s platform delivers instant time-to-value, combining the leading, accurate AI chat, with commercial contract agents that can redline directly in Microsoft Word, and custom negotiation playbooks so legal teams can review, summarize, and advise faster with greater context.

Series C: LLMs and the Chips That Power Them

d-Matrix

Santa Clara-based d-Matrix secured $275 million in Series C funding to scale its innovative AI inference chip platform. The company’s chips are designed to accelerate AI workloads, enabling faster and more efficient processing for a range of applications. This significant investment will fuel d-Matrix’s efforts to meet growing demand and further advance its technology in the rapidly evolving AI landscape.

CoLab

St. John’s, Canada-based AI startup CoLab raised $72 million in Series C funding for its AI-powered engineering design platform. While traditional engineering software can tell engineers what changed between design review versions, CoLab’s system understands why. This historical context gives its AI agents the ability to suggest design improvements and catch errors that humans might overlook.

Series D AI: No-Code Attracts Billions

Cursor

Cursor, a San Francisco and New York-based coding solutions company, raised $2.3 billion in Series D funding. The company’s platform delegates coding tasks to AI agents so developers can focus on high-level direction. Cursor has grown to over $1 billion in annualized revenue and now produces more code than almost any other LLMs in the world.

Series E: AI Infrastructure Continues to Attract Investors

Crusoe

Denver-based AI data center startup Crusoe drew in a massive $1.38 billion in an oversubscribed Series E funding round at a valuation of approximately $10 billion. The company is focused building high-efficiency, low-emission data infrastructure optimized for AI workloads and aims to address the massive energy requirements to power AI infrastructure. This recent funding is consistent with predictions and advice published in my AI Infrastructure Investment Playbook.

Series G: Legal AI Continues to Grow

Clio

Clio secured $500 million at $5 billion valuation and acquired vLex for $1 billion to establish a unified AI-driven legal platform. The Burnaby, British Columbia company’s AI-first solution integrates every aspect of legal workflows, from research and drafting to operations. “With vLex now part of Clio, along with 350+ experts in law, data, and technology joining our team, we are bringing together top talent and cutting-edge tools to build the world’s most powerful legal intelligence platform,” stated Jack Newton, Clio’s founder.

Key Themes in AI Funding

AI-Generated by Andre Bourque

Last week’s funding activity highlights a dynamic landscape driven by technological advancements and diverse industry applications. Early-stage investments are often focused on innovative startups developing AI solutions for sectors like automotive, healthcare, and consumer services, demonstrating strong interest in foundational technologies such as large language models (LLMs) and AI agents. As startups mature, funding shifts toward scaling AI infrastructure and integration, exemplified by Series B and C investments in chip manufacturing and AI-powered tools for legal, security, and enterprise markets.

Moreover, recent funding trends reveal an increasing emphasis on infrastructure and specialized chips that power advanced AI models, reflecting investor confidence in the long-term strategic importance of robust AI ecosystems. Overall, the landscape is characterized by a mixture of breakthroughs in AI capabilities and strategic investments aimed at establishing scalable, secure, and industry-specific solutions.

Underlying Drivers

- Technological Advancements: Rapid innovations in AI models, architectures, and hardware are driving increased investor interest and funding.

- Industry Applications: Growing adoption of AI across sectors such as automotive, healthcare, legal, and security creates a broad investment landscape.

- Infrastructure Demand: The need for specialized chips and scalable infrastructure to support large language models (LLMs) and AI agents attracts significant investment.

- Startup Ecosystem Growth: The proliferation of AI startups at various funding stages indicates a vibrant ecosystem fueling ongoing innovation and competition.

Feature Image AI-Generated by Andre Bourque